If you’re interested in forming an LLC (Limited Liability Company) in Arizona, this article will explain what you need to do.

Step 1 – Give Your LLC a Name

Step 2 – Statutory Agent Appointment

Step 3 – Articles of Organization Must be Filed

Step 4 – An Operating Agreement Must Be Prepared

Step 5 – Adhere to All Regulatory and Tax Requirements

An LLC (Limited Liability Company) is a method of having a business legally structured. It integrates a corporation’s limited liability with the versatility and absence of formalities associated with sole proprietorships or partnerships.

An owner of a business who wants to limit their personal liabilities (to protect themselves from business lawsuits and debts) should consider creating an LLC.

Save Time With An LLC Service

Incfile

LLC Filing, Formation, EIN (Tax ID), Operating Agreement, One-Year Registered Agent, Compliance Reminders, Express Shipping

Incfile $149 + state fee (Our Pick)

Visit Our Top 7 Best LLC Services

Arizona Corporations Commission

Mailing address:

AZCC

Corporate Filings

1300 W Washington St

Phoenix, AZ 85007

AZ Corp. Commission

AZ Corporations Division

602-542-3026

8:00 am to 5:00 pm (M–F)

Form An LLC In Arizona

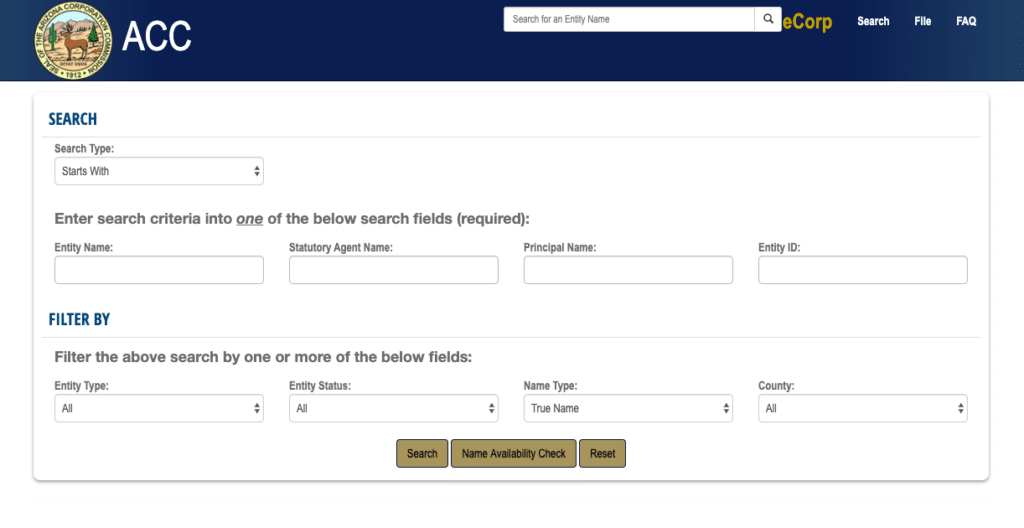

Arizona Business Name Availability Search

https://ecorp.azcc.gov/EntitySearch/Index

Steps To Create An LLC in Arizona

There are three main options to form an LLC.

Option #1: Do everything yourself

Option #2: Hire an attorney to do most of the paperwork for you

Option #3: Hire an online LLC formation service. We have some links in the next paragraph.

For info on the best LLC services, visit this link for the top 8 best LLC formation services or our list of the top 7 best LLC filings services. Shop around compare the prices before deciding the best fit for your new business.

If you reside in Arizona and wish to have an LLC formed, take the following steps.

Step 1 – Give Your LLC a Name

As per the law in the state of Arizona, the name of your LLC must have the term “Limited Liability Company” in it. Alternatively, the name can contain the following abbreviations: “LC,” “L.C.,” “L.L.C.,” or “LLC.”

The professional name needs to have the term “Professional Limited Liability Company” in it. Alternatively, the name can contain the following abbreviations: “PLC,” “PLLC,” “P.L.C.,” or “P.L.L.C.”

The name of your LLC must be different from other business entity names filed with the Arizona Corporations Commission. You can check to see if a name is available by searching their database of business names.

You can reserve an LLC name for up to 4 months. To do so, you will need to complete a form entitled “Application to Reserve a Limited Liability Company Name” and file it with the Arizona Corporations Commission. This can be done on the ACC’s website. There is a filing fee of $45 if the form is completed online or $10 if sent by snail mail (there is no $35 rush service with this option).

Trade Name Use

The legal name you officially registered for your LLC (via Articles of Organization) does not have to be used. Instead, a trade name can be used. This is referred to as a “DBA” (which is short for “Doing Business As”), and it can be a fictitious name for your company or an assumed name.

Begin by registering the LLC in Arizona with a trade name. This can be done on the Arizona Secretary of State’s website for $10. Registration does not confer legal rights, nor is it mandatory. Rather, it informs the public that a particular name is taken in Arizona.

Step 2 – Statutory Agent Appointment

All SMLLCs in Arizona are obligated to have a Statutory Agent (aka a Registered Agent) appointed. This can be a business entity or an individual who represents the SMLLC and accepts legal documents for them. This agent may be:

1) someone that is a full-time/permanent resident of Arizona, or

2) an LLC or domestic corporation, or

3) an LLC or international corporation that has the authorization to conduct commercial transactions in Arizona.

An Arizonian physical address is mandatory for the Statutory Agent. The Statutory Agent must document acceptance of the appointment – they must file the Articles of Organization with a completed acceptance form.

Step 3 – Articles of Organization Must be Filed

An LLC in Arizona must file Articles of Organization with the ACC to create it. The following must be included in the articles:

- A box checked off, indicating that an LLC is either regular or professional.

- The name of the LLC.

- If applicable, service description of the Professional LLC.

- Address and name of the Statutory Agent.

- The business address of the LLC.

- If either members or managers manage an LLC.

- The LLC organizer’s signature.

You can complete and file the articles online. You can also visit the website of the Arizona Corporations Commission and download the form for the Articles of Organization. After completing it, you can have it filed by snail mail. Ensure the Articles of Organization are included with your Statutory Agent Acceptance form.

It costs $50 to file the form. Expedited processing costs an extra $35.

Step 4 – An Operating Agreement Must Be Prepared

You don’t have to complete an Operating Agreement for an LLC, but you are highly encouraged to. This internal document establishes how the LLC will be operated. It addresses the responsibilities and rights of managers and members, explaining how an LLC will be run.

Also, it can help to preserve limited liability by revealing that the LLC stands as an individual business entity. Without an Operating Agreement, the way your LLC does business will be governed by state law.

Requirements for Publication

An LLC is not required to publish a newspaper in the County of Pima or Maricopa. If any LLCs are created in these two counties, the Corporations Commission will publish relevant info on their website. This generally is satisfactory as far as publication requirements go. If an LLC is situated in another county, publication of a Notice of LLC Formation is necessary.

This must happen within two months of the commission approving the filing of Articles of Organization by an LLC. The notice needs to be published for three consecutive months in a periodical circulated in the business’s county. Failure to post the notification may result in the dissolution of the LLC. It is not necessary to file an Affidavit of Publication.

Step 5 – Adhere to All Regulatory and Tax Requirements

Your LLC may be subject to further regulatory and tax requirements, such as the following:

EIN – if there are multiple members in an LLC, an EIN (Employer Identification Number) must be obtained from the IRS. This must also be done if an LLC doesn’t have any employees. If an LLC with one member is formed, an EIN must be obtained only if more employees are hired. The LLC is treated like a corporation rather than a disregarded entity (sole proprietorship) for tax purposes.

An EEI can be obtained online by filling out an application on the official IRS website. The IRS does not charge a filing fee.

Business Licenses – based on what kind of business it is and the place it’s situated in, the LLC you form might need state and local business licenses, too. Review the Arizona Department of Commerce Licensing Guide for state licenses.

To obtain a local license, consult the city government where the business operates (if you’re situated in an unincorporated area, check with the county).

State Tax – you may have to register with the Arizona DOR (Department of Revenue) under certain circumstances (for instance, if you employ staff or collect sales tax on goods sold). For the most part, you have the option to register on paper (Arizona Joint Tax application form JT-1/UC-001) or online.

International LLCs that are Active in Arizona – any LLC created out of the state of Arizona- are obligated to register with the ACC if they wish to conduct business in this state. For any commercial activity that physically transpires in Arizona, International LLCs must appoint a Registered Agent of Service.

This process entails the completion of the Registration Application for a Foreign Limited Liability Company. Along with the application, a Certificate of Existence (or other relevant documentation) from the home state of the LLC must also be filed. There is a $150 filing fee, though the application doesn’t warrant publication.

Before the application is filed, ensure that the name of the LLC is not already taken in the state of Arizona. You can do this by combing through business names in the Arizona Corporations Commission’s database. Assuming that they want to do business in Arizona, an international LLC must use a different (fictitious) name if the name is taken.

A facsimile of the business’s resolution to adopt this other name must accompany the application when filed. A Statutory Agent must be appointed by the international LLC, as explained in the second section.

For more information, visit how to start a business in Arizona

and how to do an Arizona business name availability search

Disclaimer – This website does not provide tax or legal advice. It is for general informational purposes only. The business formation services mentioned on our website are Document Filing Services and CANNOT provide you with legal or financial advice. If you need legal or tax advice, please consult with a competent attorney and/or accountant. Features, pricing, and service options on our website are subject to change without notice.