There are a few different kinds of business entities and structures to consider when forming a new business, including Corporations, S-Corps, and Limited Liability Companies (LLCs).

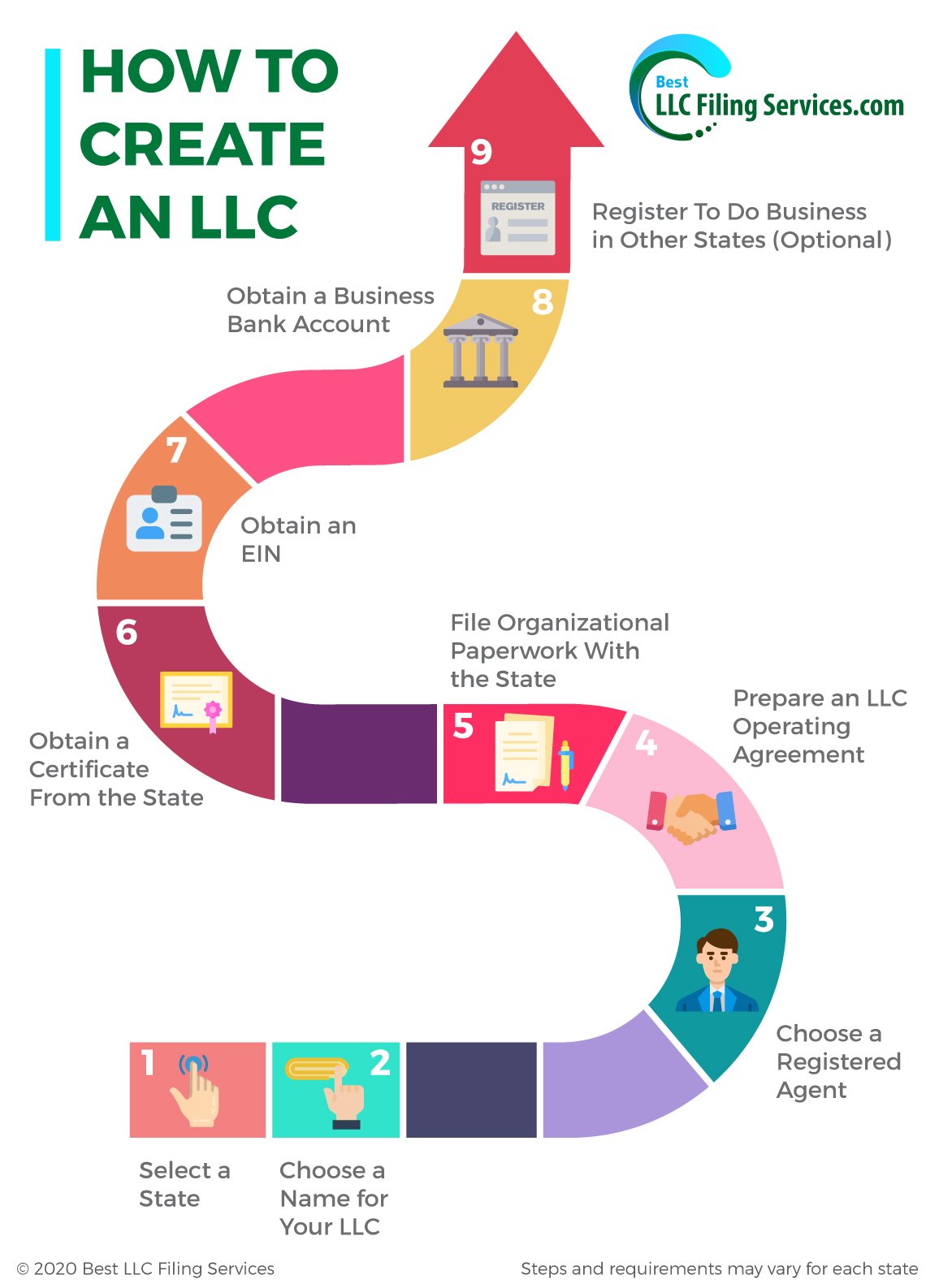

If you are interested in forming an LLC or want to know how to create an LLC, then follow these 9 easy steps.

9 Steps To Create An LLC

Step 1: Select a State

Step 2: Choose a Name For Your LLC

Step 3: Choose a Registered Agent

Step 4: Prepare An LLC Operating Agreement

Step 5: File Organizational Paperwork With the State

Step 6: Obtain a Certificate From the State

Step 7: Obtain an EIN (Employer Identification Number)

Step 8: Obtain a Business Bank Account

Step 9: Register To Do Business in the Other States (Optional)

Step One: Select a State

This is the state where your business will be operating.

Step Two: Name the LLC

The first thing to do when forming your LLC is to give it a name. It should comply with the State rules regarding company names. You can find those rules on the Secretary of State website for your state. While the rules can vary between states, here are some principal guidelines;

- The name will be unique and different from other LLCs operating within the state. You should have no problem checking the state database for your name. It’s also possible to reserve a name so no one else can claim it. This reservation costs a fee and is only available for a limited time, though. This does help ensure that your company can use the desired name once all the paperwork has been filed. Once again, though, a reserved name can’t breach the trademark of another business.

- The company name has to include “LLC” or a similar moniker. Which terms and abbreviations are considered appropriate can vary by state. You can find the rules for your state on the state website.

- The company name can’t include terms such as “insurance,” “corporation,” and “bank.” Once again, different states can have their own rules on this.

LLC Name Search By State

| Alabama

Connecticut Georgia |

Iowa | Nebraska | Rhode Island

South Dakota |

Step Three: Choose a Registered Agent

All states require an LLC to have a registered agent for the service of process. That means that an agent has to work with your LLC and physically accept the legal papers on your behalf in the event they are issued.

There’s no need for this agent to be an individual person, though. It could be any resident of the state where you do business or a business entity that has registered to do business in the state. What matters is that the agency/resident has a physical address within the state of operation.

Step Four: File Articles of Organization

You’re now ready for the third step, filing paperwork with the state so that the LLC is legally recognized and can begin operation. This is sometimes referred to as “filing articles of organization” and is also called “certificate of formation” depending on the state. The process doesn’t change much between states and names, though.

You have to supply information about the LLC to the state and pay the filing fee. You will generally be asked for necessary information such as the name, address, and ownership of the LLC.

This is also when you provide the registered agent for the business. This is the person/entity responsible for accepting legal paperwork should your company be used. The fees for filing this paperwork are nominal, but they can vary between states.

Step Four: Create the Operating Agreement

While an operating agreement isn’t always required by law, they serve the same purpose as the bylaws or partnership agreement for a corporate entity. They outline the rules of ownership and operation of the business. Here’s what should be in this operating agreement;

- What percentage of the business each member holds

- The voting power, rights, and responsibilities of each member

- How the company allocates profits/losses

- The means of management and the rules outlining meetings and votes

- “Buy-Sell” provisions outline the procedure to be followed if a member wants to sell their interest becomes disabled or passes away.

Step Five: File Articles of Organization

You’re now ready for the third step, filing paperwork with the state so that the LLC is legally recognized and can begin operation. This is sometimes referred to as “filing articles of organization” and is also called “certificate of formation” depending on the state. The process doesn’t change much between states and names, though.

You have to supply information about the LLC to the state and pay the filing fee. You will generally be asked for necessary information such as the name, address, and ownership of the LLC.

This is also when you provide the registered agent for the business. This is the person/entity responsible for accepting legal paperwork should your company be used. The fees for filing this paperwork are nominal, but they can vary between states.

Step Six: Obtain the Certificate from the State

Depending on the state where the LLC is filed, this process can be just a few weeks or even a few business days.

Step Seven: Apply for EIN and Review the Tax Requirements

Your LLC requires an IRS Employee Identification Number (EIN) unless you are a single-member LLC and don’t have any employees. It is simple enough to obtain this EIN. Just complete the form on the IRS website.

Many limited liability companies and corporates have to register with their Comptroller of Public Accounts. Many states also require that LLCs file annual reports with their Secretary of State.

There may be other requirements you need to adhere to as well, such as having to file annual franchise tax reports. Make sure to check the website for the Comptroller of Public Accounts for your state to stay updated on the latest requirements.

Step 8: Open a Business Bank Account

Check with your local bank for the needed paperwork for opening a business account.

Step 9: Register To Do Business in the Other States (Optional, as needed)

Other Considerations – Notice of Intent and Business License

Notice of Intent

While the notice of intent isn’t a requirement for all states, some will require that you publish a notice in the local newspaper stating that you intend to form a company.

You need to do this several times across several weeks to obtain an “affidavit of publication” through the filing office for your state. Check with the rules on LLC formation for your state to see if you have to do this.

Business Licenses

You will be required to obtain a state license or local license to legally operate within some industries, such as a liquor license. The kind of business you run and where you are operating will determine whether you need a permit or not. Check with the Department of Licensing and Regulation for your state to see what licenses you need.

Disclaimer – This website does not provide tax or legal advice. It is for general informational purposes only. The business formation services mentioned on our website are Document Filing Services and CANNOT provide you with legal or financial advice. If you need legal or tax advice, please consult with a competent attorney and/or accountant. Features, pricing, and service options on our website are subject to change without notice.