Austin, Texas

Texas is a business-friendly state with a robust economy and is not only the place where some of the great American companies began, like American Airlines, Texas Instruments (Inventor of the integrated circuit 1960s, inventor of the hand calculator 1970s, and innovators of today’s advanced microprocessors), but businesses continue to be drawn to the outstanding opportunities of the Lone Star State.

9 Steps To Start a Business In Texas

Step 1 – ✅ Give it a Name

Step 2 – ✅ Choose Your Entity

Step 3 – ✅ Get a Registered Agent

Step 4 – ✅ Register the LLC with the Texas Secretary of State

Step 5 – ✅ Get your Employer Tax ID (EIN)

Step 6 – ✅ Open an account

Step 7 – ✅ Get the required business permits

Step 8 – ✅ Write up an operating agreement

Step 9 – ✅ Stay on top of compliance

Every business and invention begins with an idea.

An idea was borne of boredom, epiphany, or necessity. The idea sounds great. Significant enough to be business-worthy. Great enough that some of your co-workers want in on your rodeo.

There’s just a problem. None of you knows what it takes to set up your company. Starting up a new company is a bit more complicated than what’s shown in film and TV, with all the paperwork, legalities, and decisions based on the former.

Fortunately, there are companies in Texas that help out people who want to start theirs. Most notable is Zenbusiness, an LLC formation company based in Texas and could be responsible for many businesses in the state.

Save Time With An LLC Service

Incfile

LLC Filing, Formation, EIN (Tax ID), Operating Agreement, One-Year Registered Agent, Compliance Reminders, Express Shipping

Find Your State’s Filing Fee

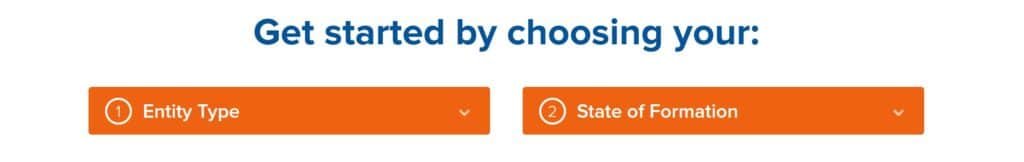

Step #1 Visit Incfile

Step #2 Click ‘Incorporate Now’ or ‘Launch My Business’

Step #3 Select “Entity Type” & ‘State of Formation’

Results ‘Gold Plan’ $149

This example,$50 State Fee for Arkansas

The state determines state fees. Some are $45, $100, $300+

Texas state fee $300

Visit Our Top 7 Best LLC Services

Business Name Search

Step 1 – First, Give it a Name

When you name something, you get attached to it. Naming your soon-to-be business can only spur your decision forward. Backing out on the idea will be less of an option.

Texas Business Name Availability Search

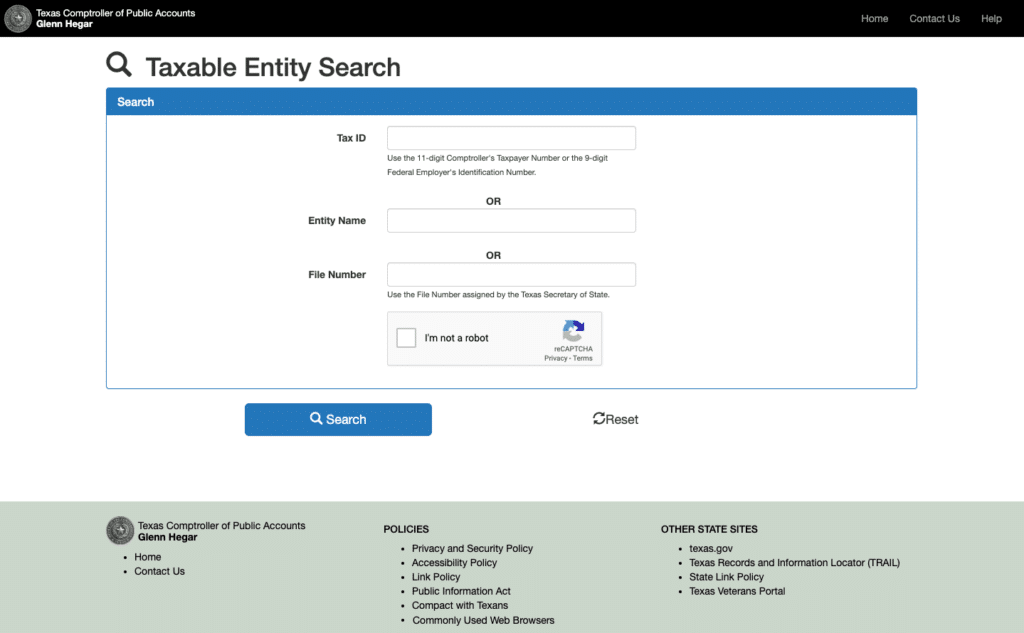

One way to do a name search is to visit the Texas Comptroller of Public Accounts and search by an “Entity Name.” The website address is https://mycpa.cpa.state.tx.us/coa/

This is a free availability search, but it is important to remember that the Texas Comptroller of Public Accounts will determine a name’s availability at the time of filing.

When forming a company, you and your co-founders need to brainstorm and decide on a few things, such as your business name. Before contacting the good folks at ZenBusiness, you need to:

-

Come up with a name that hasn’t been used before. It’s free to check with the Texas Taxable Entity Search.

-

Even if unique or derivative, that name shouldn’t sound like an existing one as the Texas Secretary of State would reject it.

-

Ensure that the name does not violate any Texas State Law

-

For more info, please visit: Texas Secretary of State FAQ

- Texas Taxable Entity Search

Texas Secretary of State

Mailing address:

Corporations Sections

Secretary of State

PO Box 13697

Austin, TX 78711

Texas Secretary of State

Texas Corporations Section

512-463-5555

8:00am – 5:00pm, M-F

corpinfo@sos.texas.gov

Step 2 – Choose Your Entity

This is an essential part of creating your company apart from choosing a name. You can choose to be a corporation or a limited liability company, or LLC. Small companies often choose LLCs because there are plenty of benefits.

-

Corporation – is a legal entity that is separate from its founders or owners. The corporation, therefore, pays for its taxes. The owners will not be held liable for the company’s taxes. Corporations can pay taxes based on their profits. The company, as a whole, is responsible for its actions. However, there will be extensive record-keeping, reporting, and definition of operations. Corporations should also have a rigid structure. Plus, corporations can be recognized as international entities.

-

LLC – is a legal entity that also provides limited liability protection that protects the company’s owners from the company’s debts and claims in case the company tanks or runs into problems. As a pass-through entity, LLC owners are considered self-employed and subject to self-employment tax. Profits and losses will be passed through to the owners’ personal income. No corporate taxes are required. Whether you’re alone or partnered, LLC profits and losses are reported to your tax return. LLCs can also have a flexible management structure as long as it is reported when compliance is due. Lastly, the LLC entity applies to American companies only.

Therefore, if your business is currently limited to the great state of Texas or soon to other parts of the US, a popular option is to become an LLC. You can look at companies like ZenBusiness for help with that. To become an LLC, there are several requirements, such as:

Step 3 – Getting a Registered Agent

A requirement to build an LLC, a registered agent, is a direct contact between a company and the Secretary of State and government offices. Like several other states, Texas requires a registered agent to allow the formation of an LLC.

For a list of the top registered agents, https://top10llcformationsites.com/best-registered-agent-services/.

Each of the companies on our Top 7 Best LLC Services provides registered agent services.

Registered agents receive correspondence or legal notices on behalf of your business and relay them to you. This way, you cannot miss or claim to miss any communication from government agencies or private vendors, or debtors.

In case your business runs into problems, registered agents can receive embarrassing letters on your behalf.

If your business, for some reason, transfers to another location, the registered agent doesn’t, ensuring that you continue to receive your correspondence. In that regard, your appointed registered agent must have a permanent physical location in the same state where your LLC is formed and must be open during regular business hours.

If your company prefers a change of registered agent, it must be filed accordingly with the Secretary of State. Business formation companies such as ZenBusiness can also act as registered agents. After finding a good registered agent in Texas, the next step is…

Step 4 – Registering the LLC with the Texas Secretary of State

Several things are required by the Texas Secretary of State when you file your LLC. Formation companies like ZenBusiness will do most of the leg work in filing the Certificate of Formation. They will also ask for this information, so you might as well be aware of the contents.

-

Article 1 – Your business name and business type (LLC/Corporation)

-

Article 2 – Address and name of the Registered Agent. Agents with physical addresses only.

-

Article 3 – Your company’s governing authority. (Who will be calling the shots, founding members or appointed managers)

-

Article 4 – Purpose of the LLC. Basically, a description of your business and its goals or mission statement. This is an optional item in case you still have to come up with one.

-

Organizer – the person or entity that prepared the Certificate of Formation. This could be you or your business formation company.

-

Effectiveness of filing – when you intend to launch your LLC as a legal entity.

-

Signature – date and signature of the organizer.

Processing

Business formation processing can be as quick as a day, a week, or can take several months. The latter is most likely without the assistance of an insider or a business formation service like ZenBusiness.

If you’re in a rush, then it’s essential to hire a business formation service. ZenBusiness, for instance, can get your business registered with the Secretary of State within 3 to 5 days for rush jobs.

There’s a little added premium, of course, but it can take from two to three weeks for regular jobs. Enough time for you to hammer things out. If you want things to be a little faster, they have an Expedited level that can get your business registered in a short 6 to 8 business days.

The term for getting your business confirmed by the Secretary of State is “filing for evidence.”

However, the Texas Secretary of State still has the last say whether the business is confirmed or not. The business name could even be rejected for some reason despite passing the criteria.

You will then would have to come up with a new name and re-file the application. Unlike others, ZenBusiness will ask for three alternate business names during sign-up, which should mitigate such a scenario.

Step 5 – Getting the Employer Identification Number or EIN

The IRS then assigns your business a nine-digit code known as the Tax Identification Number or Employer Identification Number (EIN), which banks require to open an account, hire employees, and limit liability. This EIN will also help you tell the business and personal transactions apart.

Additional EIN Details:

-

An EIN is required if your company will be hiring employees. The IRS uses company EINs for payroll tax remittances and taxes on 401k plans.

-

Your EIN shields your SSN from identity theft. You’ll be giving out your EIN to suppliers, lenders, and customers instead.

-

Should your company suffer litigation, your business becomes a separate entity, and your personal finances will not be affected, hence limited liability.

-

As mentioned above, your EIN will enable banks and other entities to treat your business and personal finances separately.

-

Speaking of banks, your company cannot start an account without an EIN.

Step 6 – Opening an Account

Keeping your personal and company money separate is one of the main points of having an LLC. Banks will not recognize your company without a separate account, and it will protect both you and your company.

Your finances will also be better organized, so it’ll be easier to track and review by you and concerned agencies. Your choice of the bank will gladly help you after showing your EIN and Certificate of Formation.

Step 7 – Business Permits

Your EIN and Certificate of Formation are just meant to recognize your company but are not licensed to run the business in Texas or anywhere.

Depending on your type of business, you’ll need business permits such as city, county, state, federal, sanitary, or environmental. Some business formation companies such as ZenBusiness have it as an added service.

Step 8 – Write-up an Operating Agreement With Important Guidelines

A business requires a document known as an Operating Agreement that describes its purpose, how the company will grow, and how it’s funded.

If you need to start the business right away and put this document on hold, your company guidelines will default to the standard rules of the state. The operating agreement should detail the following:

-

Growth – the purpose of the company and plans for future growth

-

Ownership – details a succession plan in case of ownership change

-

Protection – regulations designed to protect or separate owners’ personal assets from the LLC

-

Funding – details on how investment funds will be used, which will aid in interacting with investors.

Step 9 – Compliance

All LLCs are required to keep tabs on the state they’re registered in. This is a process known as Compliance, which is an all-important activity if you wish to continue conducting business within the strict laws of Texas.

Failing compliance in any state means that your company will have poor sanding with the state, and there will be costly fees and penalties involved. What’s worse is that the state could revoke your right to do business.

For LLCs in Texas, the state does not require much. While other states require several annual reports, Texas only requires an Annual Tax Franchise Report filed with the Texas CPA (Comptroller of Public Accounts).

All taxable entities doing business in Texas must pay and report a Franchise Tax, which is a percentage of the business’s annual income. The report’s deadline is May 15, something that should be posted everywhere in your company; otherwise, suffer poor standing as well as $50 for a late submission.

Step 10 – Let’s Get Started

-

Choose a cool business name.

-

Choose your business entity. The best choice for startups is to become an LLC.

-

Find a Registered Agent.

-

Register with the Texas Secretary of State.

-

Claiming your EIN

-

Getting a company bank account

-

Draft your company’s Operating Agreement

-

Get the necessary business permits

Most of these requirements can be done through the help of business formation companies such as ZenBusiness. The people at ZenBusiness can do the process quickly, efficiently, and, best of all, affordably.

You and your partners can then concentrate more on ironing out your ideas and pitching your company to investors and other important matters.

Starting a business is just as easy as pulling a hundred-dollar bill out of your pocket. The process can be finished in as short as a week.

Since we’ve been mentioning ZenBusiness, let’s describe their services in a little more detail:

-

First is their business filing service, which can be done online for an affordable $49 plus state fee. The state fee for Texas in 2021 is $300.

-

EIN – ZenBusiness can do this task and pay a visit to the IRS for a small price of just $70

-

Registered Agent – ZenBusiness will hook you up with a partnered registered agent, which is included in its starter package of $49.

-

Compliance Deadlines, Worry-Free Guarantee – ZenBusiness will be on top of compliance requirements, including annual reports, so that you could concentrate more on your business. They charge a small amount of $110 annually (and $75 for annual reports) unless you choose a more elevated package.

-

Business License Reports – ZenBusiness charges just $95 for business license renewals.

-

Name Reservation – is like a pre-order for a business name. ZenBusiness will keep your cool chosen business name in reserve ($50) while you iron out your idea and prepare to do business.

The prices specified by ZenBusiness are still subject to change and may even become inclusive in a preferable package.

Legalities and paperwork should no longer be an excuse from starting and doing business in Texas, thanks to online business formation companies like ZenBusiness.