Need to form an LLC in New York? There are several steps that you must take to form your New York LLC. The first steps is to name your NY LLC. Here’s everything you need to know about establishing a limited liability company in the state of New York.

New York Department of State

Mailing address:

Department of State

Division of Corporations

One Commerce Plaza

99 Washington Avenue

Albany, NY 12231

NY Department of State

NY Division of Corporations

518-473-2492

8:30 am – 4:30 pm, M-F

corporations@dos.ny.gov

Form An LLC In New York

1. Choose a Name for the NY LLC

New York Business Name Search: New York regulates that all LLCs include the words “Limited Liability Company” at the end of their name. The abbreviations “L.L.C” and “LLC” are also accepted.

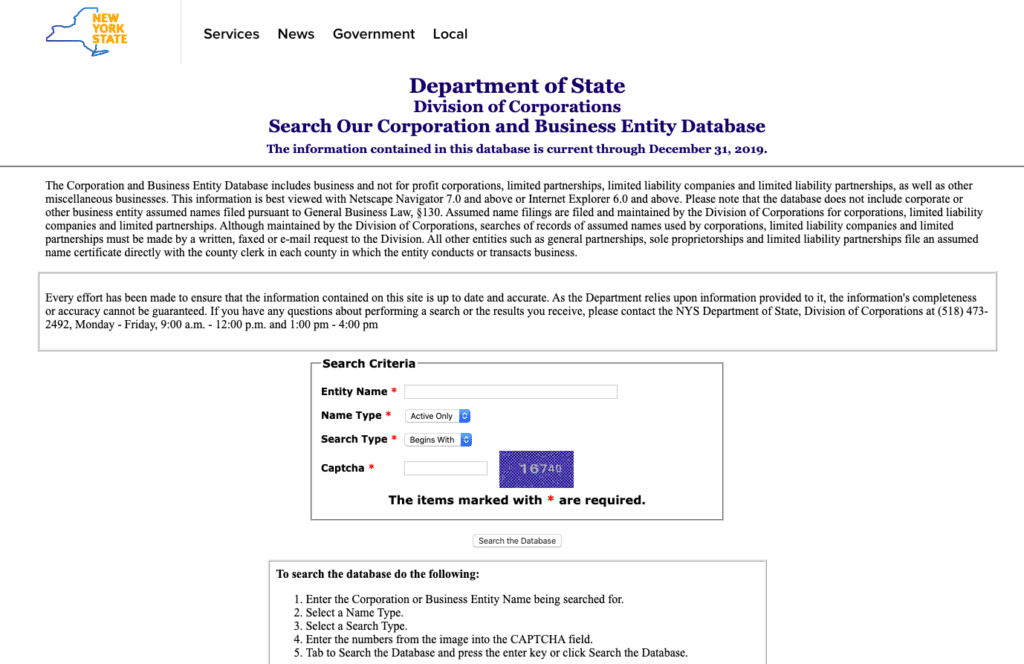

New York Business Entity Database

The name of the LLC has to be distinguishable from any other business name already filed with the New York Secretary of State. Check your desired name against the business name database of the New York Department of State Divisions and Corporations.

If your name isn’t taken, but you are worried it might be, then you can file an Application for Reservation of Name to reserve the name for 60 days. The application is sent by mail to the New York Department of State Division and Corporations.

2. Have an Address for Legal Papers

For New York, the New York Department of State itself is automatically counted as the “agent for service of process” for LLCs.

That said, you still need to file a name and address with the Department of State for legal papers to be sent, including lawsuits. You can choose a resident in New York or a commercial registered agent to receive the service of process for your LLC.

3. File the Articles of Organization

The Articles of Organization are filed to create the LLC officially. These papers are filed with the New York Department of State Division of Corporations.

The files include the name of the LLC, the address where legal documents are to be sent, and some other basic information. You can file the Articles of Organization online or send the forms in by post.

4. Prepare the Operating Agreement

Unlike most other states, it is a legal requirement in New York for LLCs to create and adopt an operating agreement. This Operating Agreement can be entered alongside the Articles of Organization or filed within 90 days of submitting the Articles.

The Operating Agreement outlines the duties, powers, rights, responsibilities, and liabilities of the members of the LLC. This agreement is not filed with the Department of State.

5. Publication Requirements

An LLC is required to publish a copy of the articles of the organization or a notice about the formation of the LLC in two newspapers within 120 days of the articles of the organization coming into effect.

The county clerk designates the qualifying newspapers for the county in which the main office of the LLC is located, which should be outlined in the articles themselves. LLCs are required to submit a Certificate of Publication along with the attached affidavits of the newspapers attached.

This certificate is filed with the New York Department of State, Division of Corporations.

6. Comply with Regulations and Tax Requirements

The LLC may be required to comply with other regulatory and tax requirements, including;

- EIN

If the LLC has more than one member, you need to obtain an IRS Employer Identification Number (EIN), even if there are no actual employees.

If you have a one-member LLC, you will only need to have an EIN if you have employees or you want to have it taxed as a corporation rather than a sole proprietorship.

Obtaining an EIN is as easy as filing the online application through the IRS website. There’s no filing fee for this one.

- Business Licenses

The State of New York may require that your business obtain permits or licenses depending on the nature of the business, such as if you serve alcohol.

You can learn more about permits and how to acquire them through the New York State Business Express website. You might also be required to obtain a local business license from the municipality the business is located in.

Get in touch with the county clerk and the clerk of the town or city of your main site of operations to learn more about local licenses.

- Annual State Filing Fee

Every domestic and foreign LLC treated as a disregarded entity or partnership for federal income tax purposes that has any amount of income, loss, gain, or deduction derived from the state of New York is subject to the annual filing fee.

This annual fee is made payable to the Department of Taxation and Finance. You will be required to file Form IT-204-LL, Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment Form.

7. Foreign LLCs

Businesses outside of New York are allowed to operate there as long as they register with the New York Department of State Divisions of Corporations first.

You can register by filing an Application of Authority with the Division of Corporations for New York. This application is filed online using software approved for this purpose by New York State.

If you don’t have access to the internet or a tax professional, then you can file it by mail if you so choose.

Disclaimer – This website does not provide tax or legal advice. It is for general informational purposes only. The business formation services mentioned on our website are Document Filing Services and CANNOT provide you with legal or financial advice. If you need legal or tax advice, please consult with a competent attorney and/or accountant. Features, pricing, and service options on our website are subject to change without notice.