Form your LLC in Michigan with these five steps.

1. Name your Michigan LLC.

2. Choose a resident agent in Michigan.

3. File the Michigan Articles of Organization.

4. Create an operating agreement.

5. Obtain an Employer ID Number EIN.

In this article, we show you the steps needed to form an LLC in the state of Michigan including how to do a free business entity name search.

Starting an LLC – or Limited Liability Company – is one way to structure your business legally. It offers a combination between a partnership and corporation through a mixture of limited liability (a feature of corporations) and more flexibility with a lack of formalities (offered by a partnership/sole proprietorship).

Business owners that want to limit their own personal liability for the debts and legal affairs of their business should consider establishing an LLC.

Each state can have different regulations according to the IRS guideline. If you are considering creating a Limited Liability Company in Michigan, follow this 7 step guide on how to form an LLC in Michigan.

Michigan Secretary of State

Mailing address:

Michigan Corporations Division

PO Box 30054

Lansing, MI 48909

Michigan LARA

MI Corporations Division

517-241-6470

8:00 am – 5:00 pm, M-F

Form An LLC In Michigan

Here’s how you can form an LLC in Michigan.

Step 1 – Pick a Name

The first step is to choose a name for the LLC. It has to end with the words “limited liability company” or an accepted abbreviation of “LLC” or “L.L.C.”

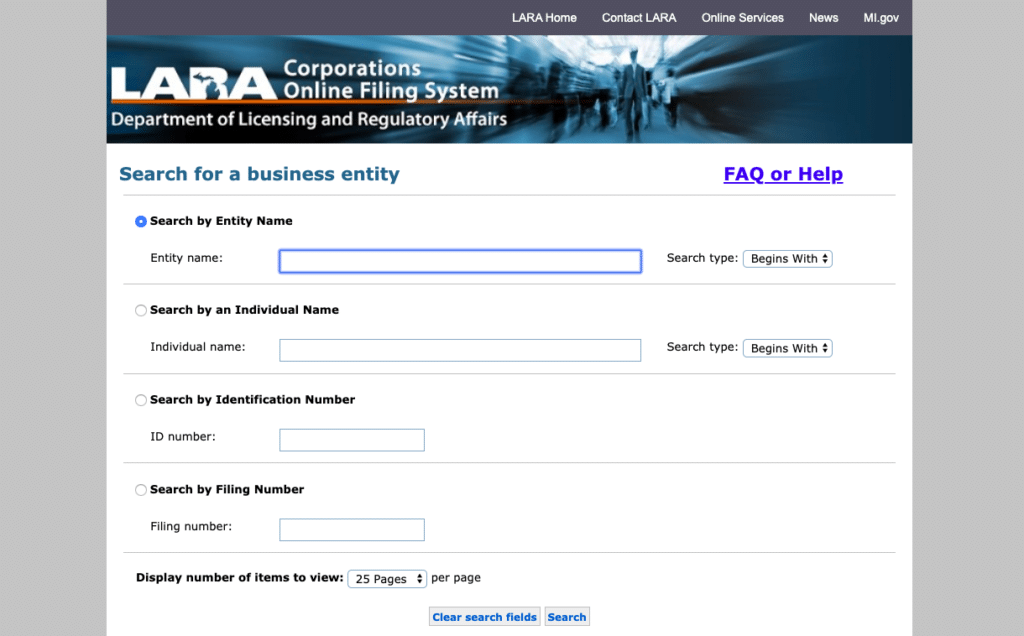

Michigan Business Entity Name Search

https://cofs.lara.state.mi.us/SearchApi/Search/Search

The name of the business must be different from other business entities already registered with the Michigan Department of Licensing and Regulatory Affairs. You can check this database for yourself through their website.

You can take steps to reserve the name for your business by filing an Application for Reservation of Name to secure your name with the Michigan Department of Licensing and Regulatory Affairs. You can submit the application online or through mail at the cost of $25.

Filing with an Assumed Name

It’s possible to do business under an assumed name instead of the one registered with the Articles of Organization. An assumed name is also known as a trade name, fictitious business name, or a DBA (short for ‘doing business as’).

You will, however, have to register the assumed name with the Michigan Department of Licensing and Regulatory Affairs. You can file your certificate of Assumed Name by post for $25. This registration lasts for five years.

Step 2 – Find a Registered Agent

LLCs in Michigan are required to have their own agent for service of process. This is a business entity or individual who agrees to accept any legal papers on behalf of the LLC in the event they are sued.

The registered agent can be a resident or corporation of Michigan, a foreign corporation that possesses a certificate of authority to do business in Michigan, an LLC in Michigan, or a foreign LLC that is authorized to do business in the state. Whoever you choose as a registered agent, they must have a legal, physical address in Michigan State.

Step 3 – File the Articles of Organization

Michigan LLCs are formally created with the filing of the Articles of Organization. These are filed with the Michigan Department of Licensing and Regulatory Affairs, and they include;

- The name of the LLC

- The purpose of the LLC

- Whether the LLC will be formed for a set time or in perpetuity

- The name and address of the registered agent

- The effective date of the filing if later than the date of filing

- Phone number and signature for the organizer

These articles can be filed online or through the mail, and there’s a filing fee of $50.

Step 4 – Prepare the Operating Agreement

Michigan doesn’t require an LLC to have an operating agreement by law, but it is still recommended to create one. This internal document outlines how the LLC is run. It sets out the rights and responsibilities of members and managers, including the actual management structure of the LLC.

This document also helps you to maintain limited liability as it shows the LLC is genuinely its own business entity. Without such an operating agreement in place, the LLC is governed by state LLC law.

Step 5 – Comply with Regulatory and Tax Requirements

The LLC may be subject to additional tax and regulatory requirements, including:

- EIN

If the LLC has more than one member, then you need to obtain an IRS Employer Identification Number (EIN), even if there are no actual employees. If you have a one-member LLC, you will only need to have an EIN if you have employees or you want to have it taxed as a corporation rather than a sole proprietorship.

Obtaining an EIN is as easy as filing the online application through the IRS website. There’s no filing fee for this one.

- Business License

Depending on the kind of business you have and where you are operating form, you may have to obtain a local or state business license. Learn more about local licenses by checking with the clerk for the town or city the LLC is based out of (or country for an unincorporated area).

For a state license, check with the State License Search at the website for the State of Michigan.

- Department of Treasury

There will be some cases, such as if you have employees or are planning to collect sales tax, that require you to register with the Michigan Department of Treasury. You can file an online registration with their website or send an application by mail.

Additional Info

File Regular Statements

Every LLC operating in Michigan is required to file annual statements with the Department of Licensing and Regulatory Affairs. This report has to be submitted by February 15 after the year of qualification/formation.

However, if an LLC is qualified or organized after September 30, it doesn’t need to file a statement by the first February 15 following formation. The registered agent for the LLC will receive an annual statement, the BCS/CD-2700, around three months before it is due. Reports can be filed online or via mail. There’s a $25 filing fee attached.

Foreign LLCs operating in Michigan

Any LLC organized outside of the State of Michigan must register with the Department of Licensing and Regulatory Affairs for the state to do business. Like other LLCs, foreign companies are required to appoint a local registered agent for service of process.

This agent must have a physical Michigan address. They can also nominate the Department of Licensing and Regulatory Affairs as their agent. Foreign LLCs have to file the Application for Certificate of Authority to Transact Business in Michigan form, which comes with a $50 filing fee.

This completed application should be sent with a Certificate of Good Standing or Existence from the home state of the LLC, which should be dated within 30 days of filing the certificate.

Foreign entities have to ensure their name is available in Michigan by checking it against the business name database. If the name has been taken already, then the foreign LLC has to adopt an assumed name for operating in Michigan.

This assumed name becomes the LLC’s name in Michigan and is used for every transaction or dealing in the state. Item 2 of the Application for Certificate of Authority to Transact Business in Michigan is filed for this purpose.

All foreign LLCs can use other assumed names to do business in Michigan, but each business name must be filed with a separate Certificate of Assumed Name.

Disclaimer – This website does not provide tax or legal advice. It is for general informational purposes only. The business formation services mentioned on our website are Document Filing Services and CANNOT provide you with legal or financial advice. If you need legal or tax advice, please consult with a competent attorney and/or accountant. Features, pricing, and service options on our website are subject to change without notice.