Form your Florida LLC with these five simple steps.

- Name Your Florida LLC.

- Choose a Registered Agent in Florida.

- File the Florida Articles of Organization.

- Create an Operating Agreement.

- Obtain an Employer ID Number (EIN).

Want to form an LLC in Florida? The IRS allows each state to use different regulations when a Limited Liability Company (LLC) is formed. If you’re interested in forming one, you should check the specific regulations of your state.

This step-by-step guide will show the process of forming an LLC in the state of Florida. Each step will be described in detail, and we’ll answer any questions you may have.

How Much Is The Florida LLC Filing Fee?

The state filing fee in Florida is $125. After the first year, there is an annual report fee of $138.75

How Long Does It Take To Get An LLC in Florida?

After filing the Florida LLC Articles of Organization takes about 2-7 business days to process.

- If you file by mail, the process takes about 5-7 business days

- If you file online, the process takes about 1-2 business days

Visit Our Top 7 Best LLC Services

Florida Department of State

Mailing address:

Registration Section

Division of Corporations

PO Box 6327

Tallahassee, FL 32314

Florida Department of State

Florida Division of Corporations

850-245-6051

8:00am to 5:00pm, M-F

Form An LLC In Florida

1. Choosing a Name

When you want a name for your LLC, your first consideration should be that it is unique in Florida and that there is no other business with the same name or close to the same name.

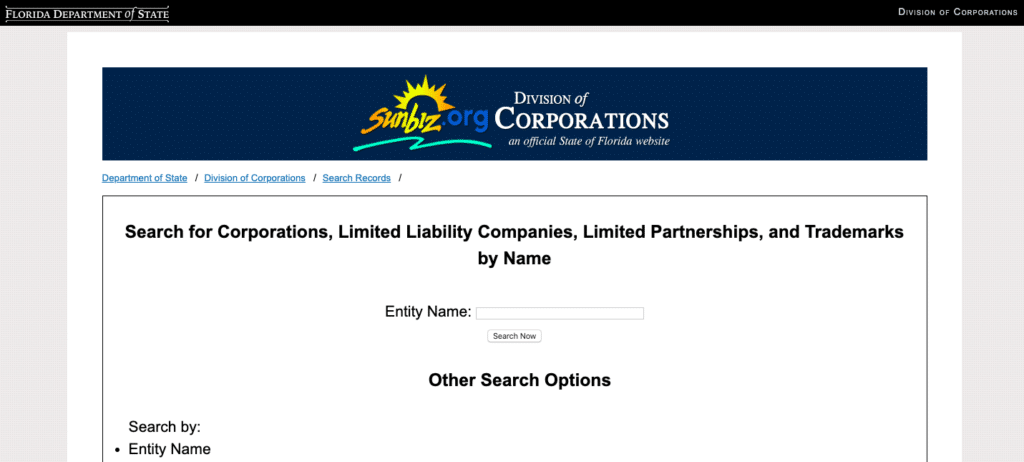

Florida Business Name Search

This can be done easily and quickly by doing a name search on the Florida Sunbiz website and verifying the business name you plan on using is available.

The company’s name must end with the term “Limited Liability Company” in some form to comply with Florida state law. This can be done by writing out the whole phrase or by using one of the abbreviations “L.L.C.,” “LLC,” or “Limited Company.”

The abbreviations for the words “Company” and “Limited” may also be used as “Co.” or “Ltd.,” respectively. Words that could indicate that LLC is a government agency must be avoided.

There are also restrictions on using words that indicate qualified professions such as an attorney, doctor, engineer, etc. If these words are used, you will need to fill in additional paperwork. This also applies to names indicating that the company is a financial institution, such as banks.

2. Appointing a Registered Agent

In Florida, it is a requirement that an LLC has a registered agent for service of process. This means that should the LLC be sued; it must have a legal entity that agrees to accept any physical, legal papers on the LLC’s behalf.

The registered agent does not have to be an individual and can be a business entity authorized to do business in Florida or any resident with a physical street address within Florida.

3. Filing Florida’s Articles of Organization

You’ll need to complete Florida’s Articles of Organization paperwork to officially create an LLC in Florida and then submit them on the Florida Department of State’s Sunbiz Website. This can be done either by mail or online, and a fee of $125 is payable.

When filing the Articles of Organization, applicants should furnish the names and addresses of the person or persons authorized to manage the LLC. Only list LLC managers here.

The state will assume members manage the LLC, and member privacy will be protected if this section is not filled in. If managers manage the LLC, only the name(s) of the manager(s) is needed, unless they are an authorized representative (such as a registered agent service) or a company.

The following will be needed to complete the form:

- The name of the LLC

- The name, address, and signature of the appointed registered agent

- The name(s) and address(es) of the managers associated with the LLC, if any

- The effective date of the LLC

4. Creating the Operating Agreement

Although the state does not require an operating agreement to outline the ownership and operating procedures, it is always a good idea to prepare one.

The operating agreement should set the guidelines for running the company. Although you don’t need to file it with the state, it can go a long way to ensure its success.

5. Reviewing Tax Requirements and Applying for an EIN

Unless the LLC has a single member with no employees, an IRS EIN (Employer Identification Number) is needed for the LLC. This is easy to obtain by completing an application on the IRS website.

Some companies also have to register with the Florida Department of Revenue. Whether or not this is required depends on the exact type of taxes it will be collecting for the state. The form DR-1, the Florida Business Tax Application, can be filed by mail or online.

Companies selling physical products also have to register for a seller’s permit by completing the relevant forms on the Florida Department of Revenue’s website.

If you plan on using employees in Florida, you have to register for Florida’s Reemployment Tax. New employers have to initially pay a tax rate of 2.7% on the first $7,000 of annual wages paid to their employees.

Other Considerations

Form a DBA (Doing Business As)

If you want to form a DBA in Florida, visit the Florida fictitious names page or this post to file a Florida DBA.

Business Licenses

Local, state-authorized, and federal business licenses may be required depending on the specific type and location of the business.

To determine the requirements, visit the Florida Business Resource page to identify which local and state permits and licenses may be needed.

The U.S. Small Business Administration’s website is also a handy resource that can be used to determine which federal permits or licenses are required for your business activities. You could also make use of professional services to do this for you.

Foreign LLCs

Foreign LLCs, also known as out-of-state LLCs, and those wanting to do business in Florida, will need to follow all the above steps.

Also, you’ll need to file a Certificate of Existence from the LLC’s home or domestic state and a Qualification of Foreign LLC form with the Florida Department of State Division of Corporations. The Certificate of Existence may be no older than 90 days before filing. The filing fee for this is also $125.

For more information, visit how to start a business in Florida

and how to do a business name availability search in Florida

Disclaimer – This website does not provide tax or legal advice. It is for general informational purposes only. The business formation services mentioned on our website are Document Filing Services and CANNOT provide you with legal or financial advice. If you need legal or tax advice, please consult with a competent attorney and/or accountant. Features, pricing, and service options on our website are subject to change without notice.