It has now become much easier to set up an online business that best fits your talents and sells the stuff you love, thanks to Etsy, eBay, Shopify, and Amazon Dropshipping.

These platforms are helping to create new entrepreneurs every day. Still, should you form an LLC, even for a small online business?

You should think about forming an LLC if you own an online business or plan to start one. Although you don’t have to be a business owner to start or run an online company, it can offer some significant benefits.

LLC – Wikipedia

A limited liability company (LLC for short) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under state law; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit.

LLC – IRS Website

A Limited Liability Company(LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit “single-member” LLCs, those having only one owner.

Start a Limited Liability Company With ZenBusiness for $0 + state fee

- Check Your LLC Name Availability

- Check Pricing in Your State

- Click on Your State to Get Started

- Save Time With An LLC Service

- Avoid Mistakes & Costly Delays

- Get It Done Right With Northwest

https://www.northwestregisteredagent.com

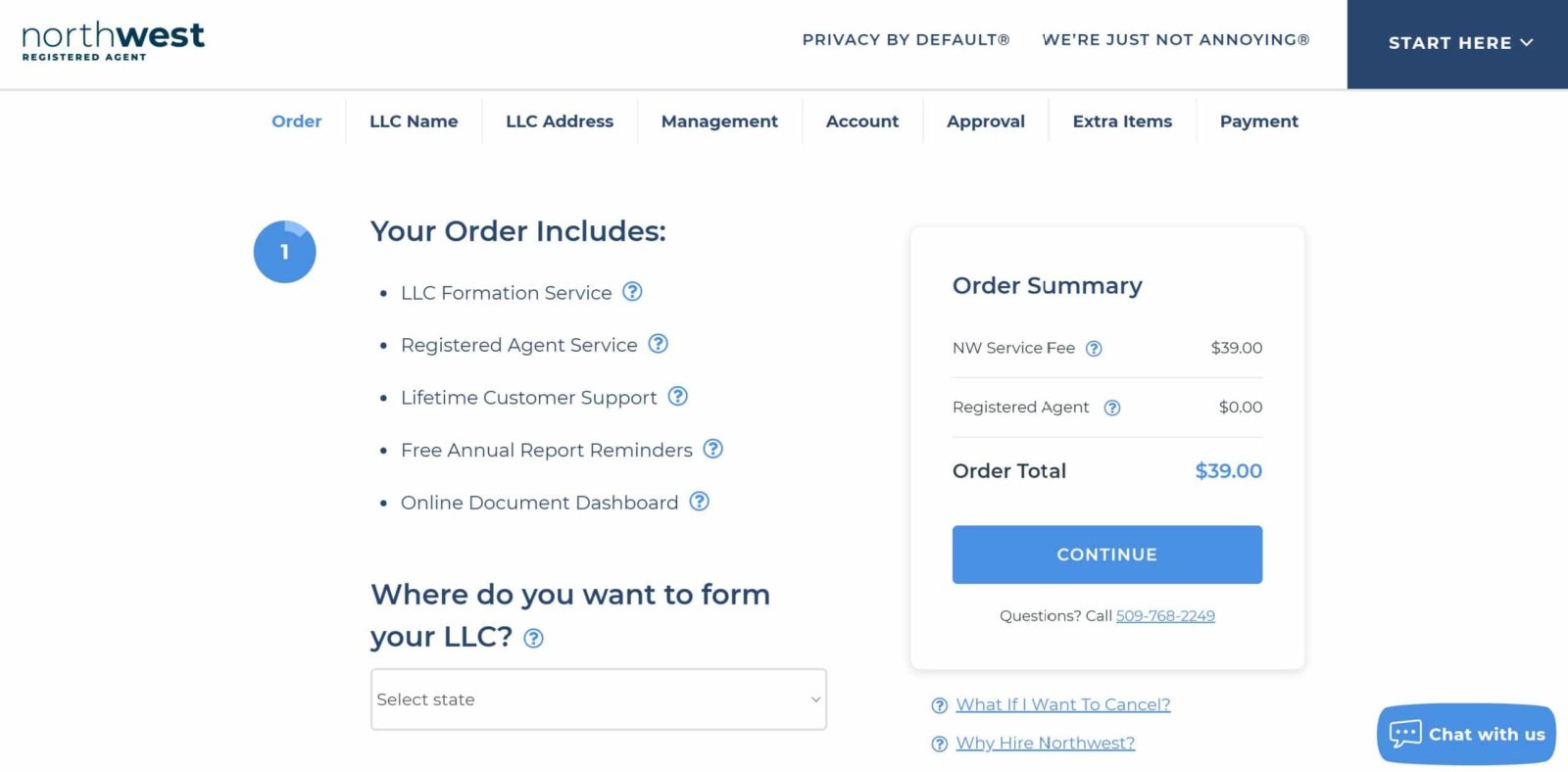

Our #1 Pick for Best LLC Service in 2023

Northwest Registered Agent

LLC formation and one year of registered agent service$225 $39

Our readers get the discounted price of just $39![]()

- VIP Monthly Plan Available!

- Northwest Pays Your State Fee Upfront!

- California LLC $37/mo

- Texas LLC $54/mo

- Georgia LLC $37/mo

The best customer service available!

Limited Liability Company: The Benefits

If you are a sole proprietor, your online business is treated as one entity. You are liable for all debts and legal liabilities that your business may incur.

Your personal assets such as your home and bank accounts could be subject to unpaid debts, legal judgments, or other legal obligations.

This is true even if multiple owners of your online business are partners in general partnerships.

On the other hand, An LLC provides limited liability to its owners. An LLC owner is not responsible for LLC business debts you don’t personally guarantee.

Only the LLC’s assets and money can be used to pay such debts. Creditors cannot touch your personal assets or property, such as your home.

LLCs usually limit your liability to small equipment and routine bills for supplies. You’ll likely be personally liable for larger debts, such as business loans.

Creditors often require small LLC owners without good credit records to personally guarantee business loans. Landlords may require you to sign a lease agreement for your LLC.

LLCs can protect you from personal liability for injuries sustained by others due to your LLC’s business activities. For example, an employee injures another person while working. An LLC can also protect you from liability if your online business is owned by more than one person.

You are responsible for any wrongdoing you do, even if your LLC is formed. It is important to have sufficient liability insurance, even if an LLC is formed.

An LLC owner can be taxed as either a regular C-corporation or an S-corporation.

It’s easy to start and run an LLC

It is easy to create LLCs. Articles of the organization or similar documents must be filed with the appropriate state office (usually the secretary of state). In most states, the cost is about $100.

An LLC operating agreement is required for an LLC with more than one member. Depending on whether you use a standard form or a custom agreement, this will cost you different amounts.

You may need to apply for other state and local business licenses depending on the location of your LLC. A fee will be required.

LLCs offer great flexibility in managing their business: members can run them or they can elect to have a management group that includes members and nonmembers. Small LLCs can be managed by members and have fewer corporate record-keeping responsibilities than larger corporations.

To transact corporate business, you must record and hold regular shareholder meetings. Even if you are the sole corporate owner, it is important to document your decisions. An LLC does not require this.

LLC disadvantages: Additional state taxes and fees

Forming an LLC can be more expensive than operating your online business solely or in partnership. These costs are usually not significant in most states. The LLC’s benefits are often worth the extra costs.

Forming an LLC is more comfortable and affordable than ever with online LLC formation sites like Incfile and ZenBusiness.

And thanks to social media platforms like Facebook, Twitter, Pinterest, and YouTube, it’s become much more comfortable and less expensive to promote your small business.

With that, the brave and the bold who decide to take advantage will find that success is not far off.

However, success comes at a price because when a small business grows, people notice, and there will be requirements to legally and effectively run it and make it develop further.

Do I Need An LLC Even for a Small Online Business

There’s also the question of possible legal entanglements should there be a problem somewhere.

And some plaintiffs often sue for an arm and a leg. Therefore you would need legal protection.

The question of business registration might rear its ugly head the moment you make your first hundred orders, and that uncomfortable feeling will only grow as your earnings do.

So perhaps, there are questions that might need answering the moment you decide to set up.

Do I need to apply for a business license, and should I register an LLC (Limited Liability Company) for my small business?

Do I Need A Business License?

The answer to the business license question is a resounding YES, that is if you want to sell legally and expect your venture to go on for a long time.

As mentioned, the government could notice, and you’ll be slapped with hefty fines if you’re discovered selling without a license (depending on local and state laws), especially if it’s food or federally regulated items.

But before you do get your business license and everything else that follows, there’s no harm in checking out if your little eCommerce Site gains traction.

If it does, and you do obtain your first hundred orders, most business consultants would agree to do so asap.

You will also need a federal license if your online store (even if it’s via platforms like Etsy, eBay, and Shopify) sells federally-regulated items. The minimum license required to sell online is called a general business license, which will allow your business to operate wherever you are located.

If your business is home-based, you may need a home occupation permit if you fulfill your sales online or offline and keep your inventory at home.

It’s only logical that you’d start from home, the same as about 70% of online business entrepreneurs, unless you or your partners have a different idea.

The home occupation permit depends on the state, though if you decide to engage in Amazon Dropshipping, the home occupation permit might not be necessary.

The state may also require you to get a seller’s permit, which will you collect sales tax, or a resale permit if the items are drop shipped from a wholesale distributor.

A seller’s permit is optional, depending on the state and the product, whether it’s federally regulated or not.

For instance, in the case of Amazon Dropshipping, you won’t need a seller’s permit (Amazon does not deal in Federally regulated items) though you might need a resale permit.

When it comes to business permits, several online companies can help you quickly deal with these requirements for surprisingly low amounts. They will also assist you with your LLC requirements.

Save Time With An LLC Service

Our #1 Pick for Best LLC Service in 2023

Northwest Registered Agent

LLC formation and one year of registered agent service$225 $39

Our readers get the discounted price of just $39![]()

The best customer service available!

Visit Our Top 7 Best LLC Filing Services

An LLC For A Small e-Commerce Site

With regard to an LLC, the short answer is no. You don’t necessarily need to form an LLC if you want to sell stuff online through Etsy, eBay, Shopify, and Amazon Dropshipping.

The long answer is, that you should because it will become important in the long run, and if you don’t form your LLC soon, you’ll be missing out on the benefits which you might need if you’re too late in creating it.

You can form an LLC at any time during your business’s lifespan, but it’s better if you do it soon, as soon as you find moderate success in your eCommerce venture.

Sole Proprietorship vs. LLC

The benefits of a sole proprietorship are its simplicity and lower costs. Its weakness is liability exposure. The advantages of an LLC are its flexibility, including taxation, and its limited liability protection.

An LLC comes with added costs and regulations, but these are minimal compared to incorporating a business.

Here are the benefits of forming an LLC for your online business:

- Provides limited liability protection, which protects the company’s owners from the company’s debts, claims, and lawsuits in case the company tanks or runs into problems. Because LLCs are legally separate from the owners, the owners are not obligated to use personal assets in paying off business debts.

- As a pass-through entity, LLC owners are considered self-employed and will be subject to self-employment tax. No corporate taxes are required.

- Profits and losses will be passed through to the owners’ personal income.

- LLC profits and losses are reported to your individual tax return, whether alone or partnered. And if you’re partnered, there doesn’t necessarily have to be equal sharing in profits based on the management structure.

- LLCs are also allowed to have a flexible management structure as long as reported when compliance is due. This means that ownership can shift from sole proprietorship to any number of partners.

- As a pro and con of getting an LLC, you will need to hire a Registered Agent whose job is to receive correspondence or legal notices on behalf of your business and relay them to you. They will act as a permanent address for your business’s state, so your customers and vendors can easily reach you. They will also receive embarrassing correspondence on your behalf.

- Your business name will be protected and cannot be usurped by a competitor. If you have not filed yet, a competitor could take your business name and litigate you into relinquishing it.

- Speaking of your business name or brand, you would also need to protect your product if it’s unique and created by you, especially those you plan to sell on Etsy and Shopify. Etsy, of course, is known for the sale of crafts.

|

If you do decide to form an LLC, we recommend Northwest Registered Agent. LLC formation and registered agent service $39 + state fee

|

Like any other business, you will still need a business plan. It’s safe to assume you plan to go into business because you’re confident with your talents and that you love your products.

You’re also under the assumption that there will be a good market for them.

With good marketing talents and product quality, you could be surprised to know that the chances of success can be pretty high even though about one-third of Americans are now somehow involved in an online business, whether it’s sales or services.

There’s a greater demand for products delivered online when it comes to sales, and it is only expected to grow.

Therefore, starting a small online business through eCommerce platforms such as Etsy, Shopify, and eBay would make sense or engaging in Amazon Dropshipping.

Therefore, you will need a business plan not just as a requirement for a business license and LLC, but for yourself, so you’ll know what to do should your business suddenly grow or falter.

Your Online Platform

There are several platforms to choose from, depending on what you intend to sell.

You could choose one or several, including Craigslist, Facebook Market, Etsy, Shopify, eBay, and Amazon. You can choose one or several simultaneously to gain maximum coverage unless you want to concentrate or there’s a significant monthly storage fee.

Below are online eCommerce platforms you can use depending on what you want to sell. You can create your online store, but you could be in for an uphill battle.

What can be sold on Etsy?

Etsy is a store that made its name through the sale of custom and handmade items. Stuff you wouldn’t find anywhere else.

Sellers often sell handmade jewelry, customized or handmade clothing, leather goods, art, vintage goods, and craft supplies.

If you’re a talented artist or craftsman, then Etsy is your platform. Now, if Etsy is only a hobby or side income, you may not need to get a business license, though should your business grow, it should be easy enough to get one.

What can be sold on Shopify?

Anything that’s not illegal. It can be a physical product such as shirts, mugs, books, electronic gadgets, or digital products like eBooks.

You can also sell services on Shopify. It’s not mandatory to have a business license to sell on Shopify though recommended if you start earning over 20,000 a month.

It depends on your State’s laws on how much product you push or what services you perform.

What can be sold on eBay?

eBay made its name from selling second-hand or rare items, but even new products can be sold here to use the platform for their eCommerce needs.

Things typically sold on eBay include consumer electronics, collectibles, crafts, clothing and accessories, toys, and sporting goods.

You can sell services on eBay, but in general, people don’t visit eBay for services. Craigslist would be more recommended. If you set up an eBay Store, you will likely need to have a business license.

What can be Dropshipped on Amazon?

Almost anything except for federally-regulated items. When choosing this platform, you will likely need a business license as well as form an LLC.

When dealing with products and services online or offline, especially when the business scale grows to warrant taxation, you should always get a business license and form an LLC.

The license permits you to run your business, while your LLC becomes your additional layer of protection. When doing business, the only way to go is up or to become self-sustaining with a modest profit.

The internet may be a gray market, but it’s still a great idea to be validated and protected.

If you plan to use an online payment processing platform like Stripe, you may want to check out Strip Atlas; it’s their business formation service. Stripe Atlas is a bit pricey, with formations starting at $500. Visit our Stripe Atlas review, where we discuss the service along with info on Clerky and Gust Launch.