What should everyone know about an LLC?

When it comes to starting a business, it is important to realize that while you may think that you have a good idea for a business, there is much more to running a business than having good ideas.

You should be aware that there is much more to running a business than making products, selling them for a profit, and collecting all cash.

As a business owner, you should know the basic differences between a Corporation, an S-Corp, and an LLC. For example, what is an LLC?

An LLC stands for Limited Liability Company.

But what exactly is an LLC?

We will try to answer that question in this article

Business Entity

An LLC or Limited Liability Company is a business entity; a business structure created back in the 1970s as an alternative to a corporation.

It is described as a cross between a sole proprietorship, partnership, and corporation.

The basic premise behind an LLC is that the member or members of the LLC cannot be held personally responsible for tax debts, company liabilities.

Even if the business is forced to file bankruptcy, the members are shielded from spending their own money to cover any debts or payments.

LLCs are not subject to corporate tax; the owner or owners list the profits and or losses on their personal income taxes.

LLC vs. Incorporation

All LLC businesses are viewed in two different ways as a legal entity and a tax entity. Each of them is handled uniquely to ensure that both parts are taken care of.

As a legal entity, this is how the courts and different levels of government view a company.

The tax entity part of a business is how the government sees it and how the tax bill is determined. Here are some details to better describe both legal entities and tax entities

Tax Entity

Setting up your business as an LLC, even if you are a single individual, has its distinct advantages, and how it is taxed is definitely one of them.

You can set up an LLC as a single person (sole proprietorship) or multiple-member (partnership) and then taxed accordingly.

The IRS offers an additional option, which makes it possible to request to be designated an S-Corporation or C-Corporation.

Just by simply filling out more paperwork, while you can choose the option of an S-Corporation or C-Corporation as an LLC, it is made difficult and cumbersome by strict guidelines to qualify for.

If you decide to look into the S-Corporation or C-Corporation option, you must file the paperwork to be designated an S-Corporation by filing an IRS form 2553. If your business qualifies, it will be taxed accordingly.

If you file an IRS form 8832 and qualify, it will be taxed as a C-Corporation. As a C-Corporation, there is an additional amount of taxation or double taxation called the corporate tax.

This type of tax does not get levied against an S-Corporation.

Establishing your business as an LLC helps you to shield yourself from paying a corporate tax on profits. It is seen by the IRS as a pass-through entity for tax purposes, and therefore you as the owner are considered self-employed.

As such, you only pay individual tax, and in the case of a multi-member LLC, each person would be taxed separately.

As far as taxation goes, you must weigh all of your options and consider them very carefully before you make any decision that involves taxes.

Legal Entity

A legal entity such as a business formed as a corporation is how the owner or ownership group is completed shielded from any legal issues that might arise in the day-to-day operation of the business.

As a corporation, all taxes and complete liabilities are fully handled, leaving the owner completely free of any responsibility.

Limited Liability Companies or LLCs were first introduced in the US back in the 1970s, and their popularity has steadily increased over the years.

The limited nature of the LLC makes it very attractive to business owners who really like its liability protection, unique taxation options, and flexible management choices.

They also like how it offers a more streamlined bookkeeping process than typical corporations.

As a legal entity, an LLC was established to help provide an owner or ownership group a strong shield against liabilities. These liabilities include things like business debts, claims against the business.

This means if any compensation is ordered to be paid to a claimant, it won’t be the individual responsibility of the owner to cover any of the judgments against the business.

Benefits of an LLC Formation For a Business

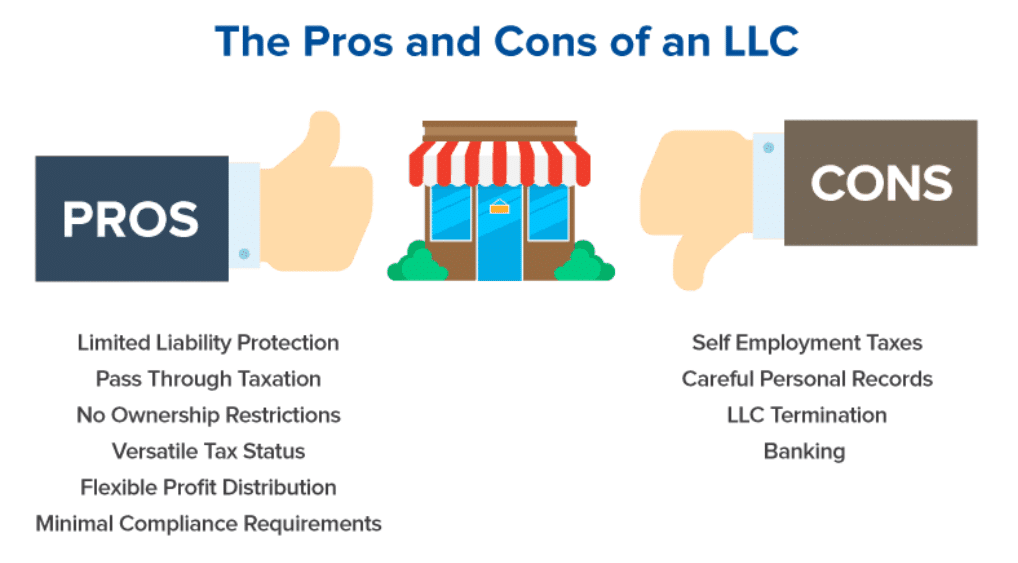

There are definitely several well-recognizable benefits for a new business owner to choose an LLC when starting their business. For this post, we put together a good list of the top benefits of choosing an LLC.

Individual Asset Protection

First and foremost, an LLC is about protecting assets for the owner or ownership group. By forming an LLC, you are not liable for anything that happens to the company.

All claims for financial or legal standing can only be made against the company itself. There is no need to worry about your nest egg being taken if the company ends up filing bankruptcy or incurs a massive debt.

Creates an officially recognized company

Creating an LLC makes it official; the government recognizes your business. The fact that the government now recognizes it at several levels will help with attracting new customers.

Prospects will look at your small business more carefully now that you have decided to form an LLC. As an LLC, your business will gain instant credibility.

No corporate income tax

The second-biggest benefit is the avoidance of paying any corporate tax, better known as double taxation. As an LLC, the owner or ownership group claims any profits or losses on their personal income tax, and that is it.

The IRS does not get any additional income from the business like it would a corporation.

Management Structure is highly flexible.

By rule, a corporation must have a rigid management structure, which includes having a board of directors that must meet every year to go over company business policies and make decisions.

An LLC does not have quite the rigid structure requirements and remains flexible regarding how it manages its day-to-day operation.

Multiple owner options are available.

An LLC can have as many owners within the group, and each of them is referred to as a member.

There is no restriction on how the percentage of ownership is broken up for each of them.

There is no limitation placed on how the capital is split up among the members in an LLC.

Much less cumbersome financial reporting required

Paperwork is usually far down on the list of priorities for most business owners when trying to run a successful business.

Fortunately, an LLC has a far smaller obligation to all levels of government as compared to a corporation. This frees the owner to have more time to worry about running their business.

Disadvantages to an LLC formation for a business

As with most things in business, there are also some fairly big downsides to an LLC. We have identified two very glaring disadvantages that you might want to think long and hard about before forming your business as an LLC.

LLCs are not recognized outside the US.

If you had dreams of selling your products or services to overseas customers, you might have a bit of a problem.

LLCs are not recognized as companies outside of the US, and therefore you would be at an extreme disadvantage when it comes to competing against other corporations for business.

There are no stocks to be issued or dividends paid out

With an LLC, the owner or ownership group maintains all of the profit and capital, so there is no ability to raise money by offering stock in the company.

This means you have to be much more creative when it comes to raising capital to expand the business.