Corporations – What Are They Exactly?

Corporations impact just about all facets of your day-to-day activities. But if we were to ask you to describe a corporation, what would you say? You might describe a corporation as an organization with a particular distinction that separates it from its owner(s).

Would your accountant give the same description, though? Would a court of law? And why do owners opt to incorporate their businesses rather than register them as a partnership or sole proprietorship?

Tax Entity and Legal Entity

“Tax entities” and “legal entities” should be described first to answer the question, “what is a corporation?” We can see what a corporation isn’t in contrast to other kinds of organizations you have the option to form, like an LLC.

The way a company is taxed is referred to as a “tax entity.” For instance, a C corporation faces “double taxation” because of both the owner and the corporation.

Since the corporation is a legal entity of its own, it is taxed as such – when a C corporation generates revenue, taxes must be paid on the income. When a C corporation’s shareholders obtain their portion of that revenue, they pay taxes on that income.

As far as the law and the state are concerned, a “legal entity” is treated like a person. Therefore, they are susceptible to lawsuits, are beholden to contracts, take responsibility for their actions, and incur debts.

A business owner may form an LLC (limited liability company) or corporation to separate themselves from their companies. If a business owes debts, people who wish to be reimbursed will need to deal with the company rather than the owner.

The Definition of a Corporation

So, what is a corporation, then? It is a company with a legal entity of its own, as recognized by the state. People own percentages of the company, making them “shareholders.”

These individuals are comprised of individual investors and company founders. Shareholders are responsible for the debt and liability of a corporation, but they also share in its profits. A Board of Directors is elected by shareholders to handle the company’s daily operations.

To define a corporation even further, compare it to an LLC, which is just as popular as a business model. Check out the advantages and disadvantages of each model in the chart below:

Corporation Advantages

Let’s go over a number of the clear benefits that come with incorporation:

- Personal Assets are Safeguarded – a corporation allows you to protect your company’s risks, liabilities, and personal assets. If someone has an accident in your workplace and files a lawsuit against you, they can sue the corporation only (rather than you personally). In the event of company bankruptcy, those you owe money to can only chase the bank account of your corporation, as opposed to your personal savings account.

- Your Business is Officially Established – what a corporation is formed, a business is officially established. Potential customers and the state see your company as legitimate. To put it another way, you are probably more comfortable hiring a company named “Jones, Inc.” than “Mike Jones.”

- International Recognition – when a business is legitimate, it carries standing outside of the country it is situated in, too. This allows you to conduct business transactions away from home.

- Permits the Issuance of Stock – a corporation’s shareholder structure is comprised of limitless owners. By selling stock shares this way, people are more willing to invest in the company. This is perfect for start-ups if they require significant capital to get up and to run.

Corporation Disadvantages

A corporation isn’t all sunshine and roses, though, as you can see from the following points:

- Double Taxation – this is a significant disadvantage of a corporation – C corporations in particular. When a corporation makes a profit, the revenue gets taxed at a corporate level first. Taxes must be paid by shareholders who receive dividends, also.

- Management Structure is Rigid – corporations have more rigidity with regards to how they’re operated and owned. Every shareholder owns a percentage of the business. A corporation must elect a board to manage the company (though it is not unusual to see corporations run by one person who represents the whole board).

- Greater Bookkeeping and Reporting Duties – a corporation’s rigid structure warrants greater bookkeeping and reporting. Though these requirements differ by state, corporations are under more scrutiny than other forms of businesses. Just about every state requests a yearly report from a corporation. Some states force corporations to maintain minutes for the Board of Directors and shareholder meetings.

Corporation Types

You must understand the distinctions between corporation types to determine which one can address your needs the best:

- B corporation – (a.k.a. “benefit corporation”) – what separates B corporations from their counterparts is intended for the environment, community, workers, and society.

- S corporation – an S corporation is seen as a “pass-through entity” and, as such, isn’t subjected to income tax on a corporate level. To bypass double taxation, the personal tax returns of a shareholder are where the profits are directed towards.

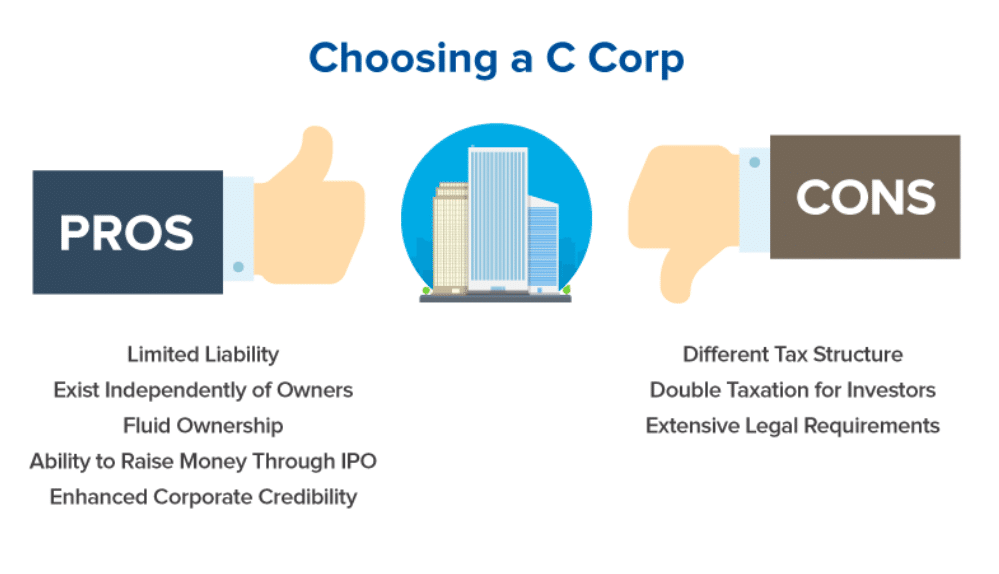

- C Corporation is the most popular one of its type; it is taxed as a business entity. Each owner is individually taxed for any payments made to them from the company.

You can now answer the question, “what is a corporation?” and can determine if it’s a suitable business model for your organization. Check out our article titled What Is An LLC? for more information.

Need To Save Time?

LLC Formation & One-Year Registered Agent Services!